Must-Read Books For Investing - By Tommy Shek

Tommy Shek Lists Must-Read Books For Investing

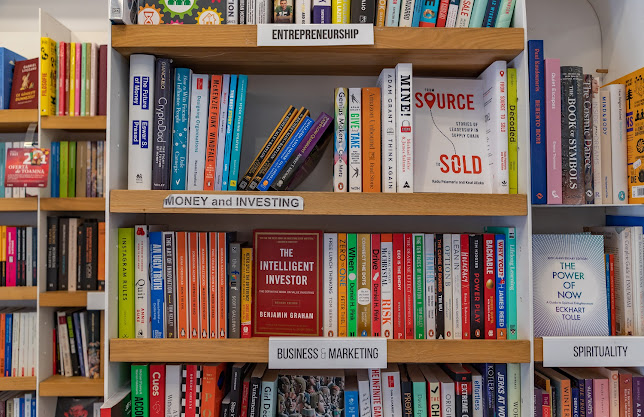

1. The Intelligent Investor by Benjamin Graham

According to Tommy Shek, the Intelligent Investor is a classic book written by Benjamin Graham, known as the father of value investing. This book provides the foundations of value investing and has stood the test of time, influencing some of the best investors in the world. The book emphasizes the importance of understanding the fundamentals of a business and the market in which it operates and how to use this information to make sound investment decisions.

2. One Up On Wall Street by Peter Lynch

One Up On Wall Street is another classic book that has been extremely influential in the investment world. Written by Peter Lynch, a former fund manager at Fidelity Investments, the book provides insight into how Lynch achieved his phenomenal success as an investor. The book is easy to read and provides a step-by-step guide for investing in the stock market.

3. The Little Book of Common Sense Investing by John C. Bogle

John C. Bogle, the founder of Vanguard Group, wrote this book to teach investors how to build a low-cost, diversified portfolio that will consistently beat the market. The book argues that most active fund managers fail to beat the market, and investors are better off investing in a low-cost index fund. The key takeaway from this book is that investors should focus on keeping investment costs low and not trying to beat the market.

4. Security Analysis by Benjamin Graham and David Dodd

Security Analysis is another book written by Benjamin Graham and David Dodd that provides an in-depth analysis of how to evaluate stocks and bonds. The book provides a comprehensive framework for analyzing financial statements, valuing companies, and assessing their financial health. It is considered the bible of value investing and is a must-read for anyone who wants to become a serious investor.

5. The Essays of Warren Buffett by Warren Buffett

Warren Buffett is one of the greatest investors of all time, and this book provides a compilation of his letters to shareholders over the years. The book provides insight into how Buffett thinks about investing and the principles he follows. The book is a must-read for anyone who wants to understand the philosophy of value investing.

6. A Random Walk Down Wall Street by Burton Malkiel

A Random Walk Down Wall Street provides insight into the principles of passive investing, which is investing in index funds and diversifying one's portfolio instead of trying to beat the market. The book argues that most active fund managers fail to beat the market and that investors are better off investing in low-cost index funds.

7. The Psychology of Money by Morgan Housel

The Psychology of Money is an excellent book that explores the relationship between money and human behavior. The book provides insights into why people make irrational financial decisions and what we can do to avoid them. It is an easy and enjoyable read that will help readers gain a better understanding of their own financial behavior.

Tommy Shek’s Concluding Thoughts

In conclusion, these are

some of the must-read books for investing that will help anyone who wants to

become a successful investor. These books, as per Tommy Shek, provide valuable

insights into the principles of investing and the fundamentals of the market.

Even if one doesn't have a finance background, one can still learn and benefit

from these books. These books are a great investment for anyone looking to

improve their investing skills and knowledge. Happy reading!

Comments

Post a Comment